Results in a snapshot

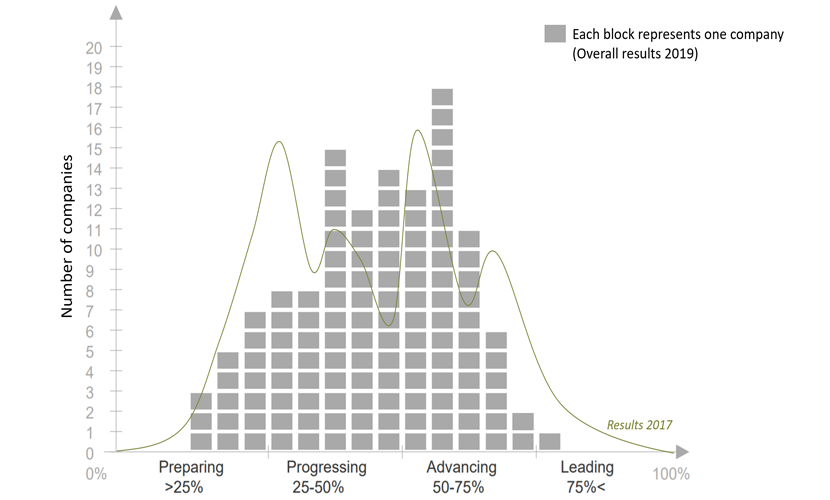

As in 2017, the majority of companies are in the mid-range, with 54 companies reaching between 25% and 50% of the achievable points (progressing) and 53 companies between 50% and 75% (advancing). 15 companies are in the “preparing” phase, by reaching less than 25% and 1 company is leading, by exceeding the threshold of 75%. Compared to 2017, the field moved closer together, with fewer companies in the “preparation” but also in the “leading” phase.

Biggest improvement potential:

- Conducting a materiality analysis and disclose process and results

- Setting SMART and impact-oriented targets up to 2030

- Engaging stakeholders and disclosing as well as integrating stakeholder feedback

- Focusing on hotspots along the value chain

- Reporting on critical cases/issues of the company and industry

TOP 3 companies in 2019

Clariant

Clariant is a Swiss speciality chemicals company, focusing on care chemicals (consumer and industrial), catalysis, natural resources (oil & mining, minerals), and plastics & coatings. The integrated report 2018 describes the materiality process and results in great detail and discloses stakeholder feedback on all material issues.

LafargeHolcim

LafargeHolcim Ltd is a Swiss multinational company that manufactures building materials. The company reports on material topics of the company, as well as many relevant issues for the industry and at global level (inside-out & outside-in perspective). Furthermore, it sets SMART and impact-driven goals.

Weleda

Weleda is a Swiss multinational company that produces both beauty products and naturopathic medicines, based on anthroposophic principles. Weleda’s 2018 Annual and Sustainability Report is distinguished by a clearly defined, integrated business and sustainability strategy that is reflected throughout the report.

Industry Ranking

On average, all sectors score around 45% (in 2017: 47%), with the food and beverage sector scoring highest with 58% and real estate scoring lowest with 33%. The sectors scoring above 50% – hence those classifying as ‘advancing’ sectors – are food & beverage, chemistry & pharmaceutical sector, retail & wholesale trade as well as construction builders & suppliers.

%

Average score

- Food & beverage sector (2017: 46%) 58%

- Chemistry & pharmaceuticals (2017: 51%) 57%

- Retail & wholesale trade (2017: 51%) 56%

- Construction builders & suppliers (2017: 57%) 51%

- Other service providers (2017: 59%) 48%

- Insurance services (2017: 42%) 46%

- Gastronomy & hotels (2017: 54%) 44%

- Mobility, transport & logistics (2017: 47%) 43%

- IT, Medical & electrical engineering (2017: 47%) 42%

- Machine industry (2017: 47%) 41%

- Energy supply & distribution (2017: 36%) 40%

- Financial services (2017: 42%) 40%

- Manufacturing industry (2017: 38%) 40%

- Real estate (2017: 35%) 32%

Average score per category

%

Comprehensive reports

(2017: 47%)

%

Credible priorities

(2017: 36%)

%

Relevant issues

(2017: 57%)